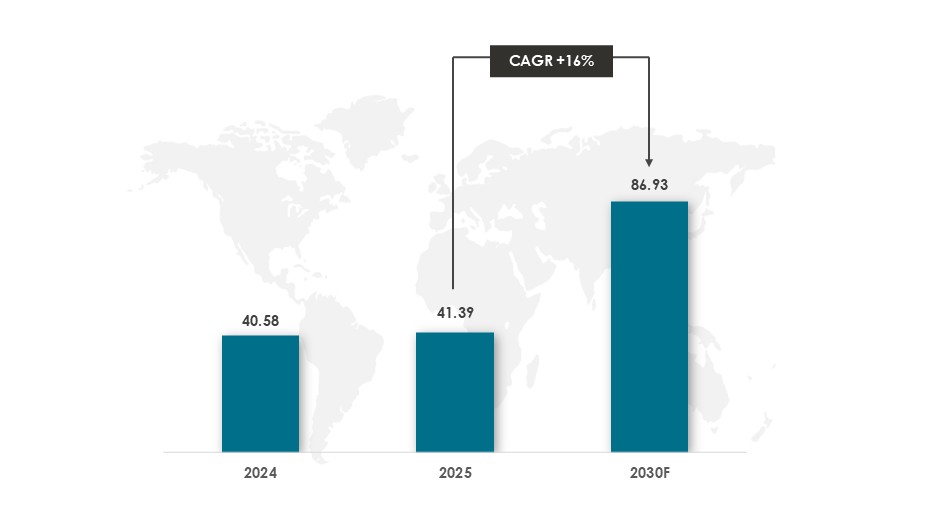

Global PropTech Market set to double by 2030

The global PropTech market is experiencing significant growth as real estate adopts digital transformation through AI, IoT, big data analysis, blockchain, and cloud technologies to modernize operations and enhance various user experiences. This modification is redefining how properties are bought, sold, leased, managed, and invested in across both residential and commercial sectors.

In 2024, the Global PropTech market was valued at approximately $40.58 billion. The Global PropTech market is expected to grow and reach ~$86.93 billion by 2030.

The Global PropTech market is projected to grow at a CAGR of ~16% during the forecast period from 2025 to 2030. Key Drivers: The Global PropTech market is driven by the expanding implementation of digital platforms that automate property management, leasing, and tenant engagement processes. The shift toward smart real estate solutions, virtual tours, 3D Visualization, augmented reality, and online transactions is also facilitating demand for more seamless and well-organized experiences across the sector.

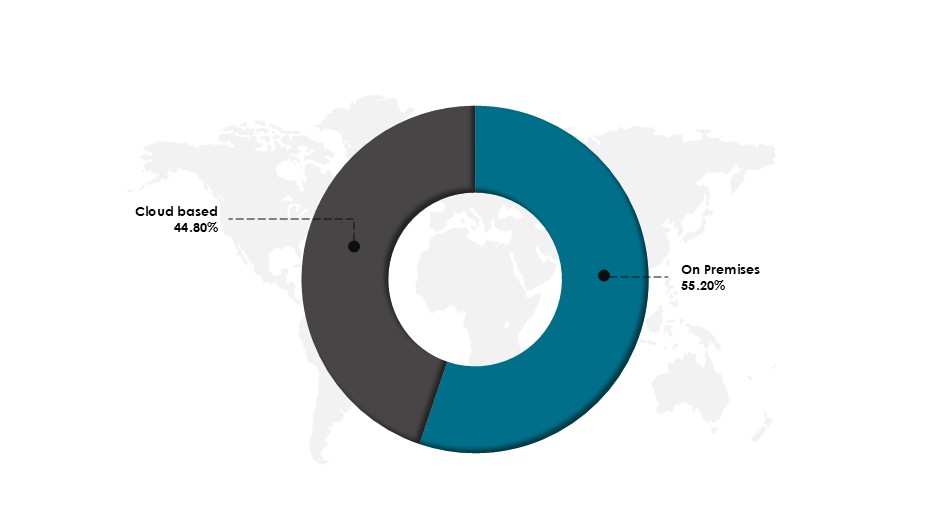

Breakdown

On-premises: In 2025, On-Premises Deployment holds the highest market share of 55.20%, driven by enhanced data security and full control over infrastructure. It is important for commercial real estate that requires local server management and operational autonomy.

Cloud-based: Cloud-based Deployment captures about 44.80%, enabling remote access, scalability, and reduced hardware dependency, which appeals to users seeking lower upfront costs and flexible property tech integration across sites.

Some Notable Partnerships in the Global PropTech Market

Reental & PropHero & Core Capital:

Reental, PropHero, and Core Capital launched the €1.6 Million ($1.8 Million) Valencia 12 project in Serra as part of a €120 Million ($139 Million) plan to deliver over 1,000 homes using tokenized real estate investment. The collaboration aims to address Spain’s housing shortage by covering the entire investment phase and leveraging smart technology and data-driven solutions.

IPS & DigitMe & PropTechBuzz:

In 2025, IPS announced a strategic partnership with DigitMe & PropTechBuzz to lead the IPS Prop-Tech Hub, showcasing over 300 PropTech firms at Dubai World Trade Centre. The partnership aims to position Dubai as a worldwide Prop-Tech hub, facilitating creation through AI, IoT, and blockchain-driven real estate solutions.

CBRE India & Nasscom:

In 2023, CBRE India partnered with Nasscom to launch the second edition of its PropTech challenge, ‘DISRUPTECH 2.0’, intended at supporting and mentoring startups across ESG, fintech, construction technology, and indigenous, using technologies such as AI, IoT, and VR, as a part of an industry that secured $3.42 Billion in private equity funding in India between 2009 and June 2022.

Some Notable Investments in the Global PropTech Market

Huspy: In 2024, Huspy raised $59 Million in Series B funding, driving a 20-fold growth in Spain and managing more than $7 Billion in annual operations across Europe and the Middle East, and plans expansion in Spanish cities and entering the Saudi Arabian market.

Spintly: In 2024, Spyre VC invested ₹3.5 Cr ($0.42 Million) in Spintly, whose smart building solutions cover 24 Million sq. ft. and serve 0.5 Million users across more than 500 customers. Backed by CREDAI, the move aligns with the global smart building market’s projected to reach $247.17 Billion by 2032.

Prop-AI: In 2025, Dubai-based Prop-AI raised $1.5 Million in pre-seed funding and tripled its Q1 revenue, directing to scale its AI-powered real estate platform across the MENA region and Europe with enhanced data integration and enterprise tools.

Conclusion

The Global PropTech market is rapidly transforming the real estate landscape by adopting cutting-edge digital technologies to streamline operations and boost user experiences. Strategic alliances and technology-driven innovations are fostering smarter, more efficient property transactions and management. This transformation is redefining both residential and commercial real estate ecosystems globally.

Data Sources: Zion Market Research, Precedence Research, Market Research Future, Allied Market Research, Cinco Dias, Coherent Market Insights Pvt Ltd, WORDPRESS.ORG., Proptech Connect Ltd, Cinco Dias, Mediasset Holdings, and Wamda

Other Market Insights