Football Meets Innovation: Inside Europe’s Booming Broadcast Tech Market

The football broadcasting industry is transforming by shifting consumer preferences and technological advancements. Viewers commonly criticize traditional broadcasting practices because they include disruptions while using multiple camera setups that produce substandard viewing for spectators at home.

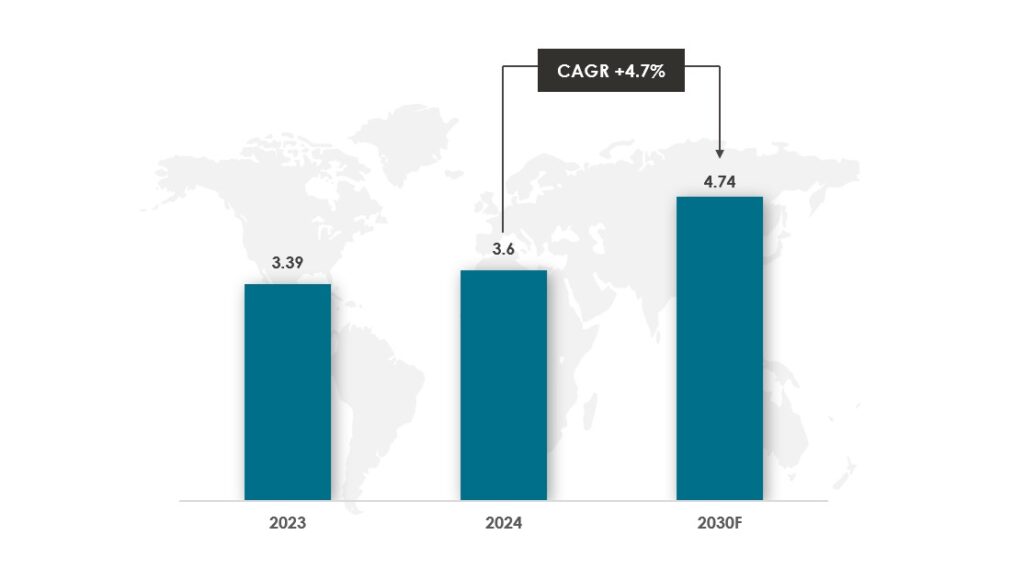

Europe Football Broadcasting Technology Market

In 2024, the Europe football broadcasting technology market was valued at $3.60 billion. The Europe football broadcasting technology market is expected to grow and reach to $4.74 billion by 2030.

The football broadcasting technology market in Europe will be growing at an approximate CAGR of 4.7% during the forecasted period 2025-2030.

Football segment represented 34.3% of the European sports broadcasting market.

Key Drivers: The popularity of leagues such as the Premier League, La Liga, and UEFA Champions League, coupled with high viewership and lucrative media rights deals, drives the market in Europe.

Broadcasting Revenue

In the 2023-2024 season, the top 20 professional football clubs in the big five leagues in Europe collectively earned approximately $11.54 billion, with broadcast revenue accounting for $219.46 million (38%) of the average club’s total earnings.

Breakdown By Clubs in Europe

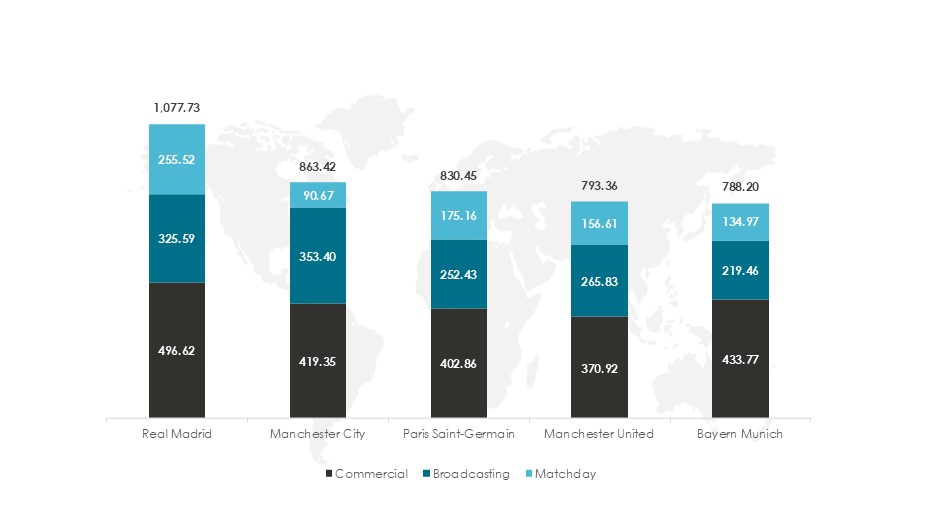

The revenue breakdown of the top football clubs, highlighting the percentage derived from broadcasting rights, is as follows:

Real Madrid: The club generated $496.62 million from commercial activities, $325.59 million from broadcasting, and $255.52 million from matchday revenue. Broadcasting accounted for 30.2% of the total revenue of $1,077.73 million.

Manchester City: The club’s revenue consisted of $419.35 million from commercial sources, $353.4 million from broadcasting, and $90.67 million from matchday revenue. Broadcasting contributed 40.9% to the total revenue of $863.42 million.

Paris Saint-Germain: The club earned $402.86 million from commercial sources, $252.43 million from broadcasting, and $175.16 million from matchday revenue. Broadcasting made up 30.4% of the total revenue of $830.45 million.

Manchester United: The club’s revenue included $370.92 million from commercial activities, $265.83 million from broadcasting, and $156.61 million from matchday revenue. Broadcasting accounted for 33.5% of the total revenue of $793.36 million.

Bayern Munich: The club generated $433.77 million from commercial sources, $219.46 million from broadcasting, and $134.97 million from matchday revenue. Broadcasting represented 27.8% of the total revenue of $788.2 million.

Some Notable Partnerships With European Football Clubs for Broadcasting

Europe

EFL and Sky Sports: The English Football League (EFL) secured a record domestic rights deal with Sky Sports in 2023, valued at £935 million over five years, starting from the 2024/25 season. Sky Sports effectively replaced the EFL’s domestic video streaming option provided via iFollow and Club streaming services.

DAZN and European Football Leagues: In 2024, DAZN announced an eight-year partnership with the European League of Football (ELF) to broadcast all 101 games of the 2025 season. This agreement includes the launch of an ‘ELF Game Pass’ product, consolidating ELF’s matches on a single platform and enhancing fan experience through seamless access.

LaLiga and Microsoft Azure: LaLiga partnered with Microsoft Azure in 2024 to revolutionize its broadcasting capabilities. This collaboration focused on using advanced technologies such as AI and machine learning to enhance content personalization and improve viewer experiences. Features include personalized content recommendations, multiple camera angles, real-time replays, and tailored broadcasts based on individual viewer preferences.

Stay tuned to Innovius Research for ongoing market insights and data-driven analysis.

Data Sources: Statista, Deloitte, Sportcal, Sportsvideo.org, Sportspro, and others

Other Market Insights