Tokenization & Decentralized Currency: The New Backbone of Digital Finance

A decade ago, “crypto” felt like a different world. Now, the same systems allow real-world transactions, central bank experiments, and the next stage of capital markets. Tokenization involves turning real-world assets (RWAs), such as funds, bonds, or real estate, into blockchain tokens. This process promises around-the-clock markets, quick settlements, and shared ownership.

At the same time, decentralized currencies – stablecoins and CBDCs, aim to reshape money itself. Jointly, they define a trend and also a transformation of finance, with assets, payments, and identity becoming programmable. Independent estimates now indicate that tokenized assets could attain the multi-trillion-dollar mark by 2030, while central banks are simultaneously progressing with CBDCs.

India Market

India is moving on two tracks. First, the Digital Rupee (e₹) – India’s Central Bank Digital Currency (CBDC). Next, on tokenization, India’s international finance hub (GIFT City) is crafting rules to allow RWAs to be issued and traded in a regulated environment.

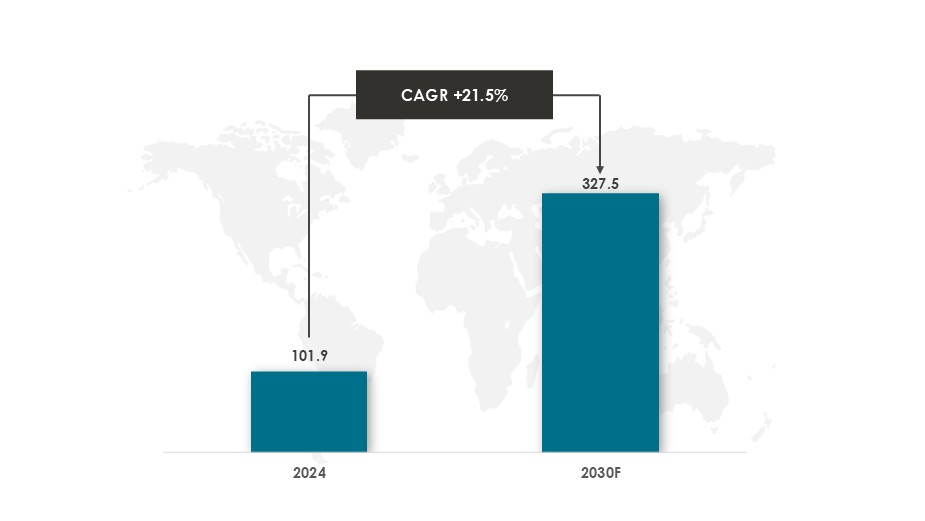

In 2024, the India Tokenization market was valued at $101.9 million and is expected to grow and reach $327.5 million by 2030.

The India Tokenization market will be growing at an approximate CAGR of 21.5% during the forecasted period.Key Drivers: India’s tokenization push is accelerating, propelled by fintech innovation, government-led digitalization, and a tightening regulatory framework. SEBI’s exploration of blockchain in capital markets and emerging standards, such as the National Digital Asset Framework (NDAF), is laying the base for tokenized securities and compliant digital asset markets.

Market Trends and Statistics

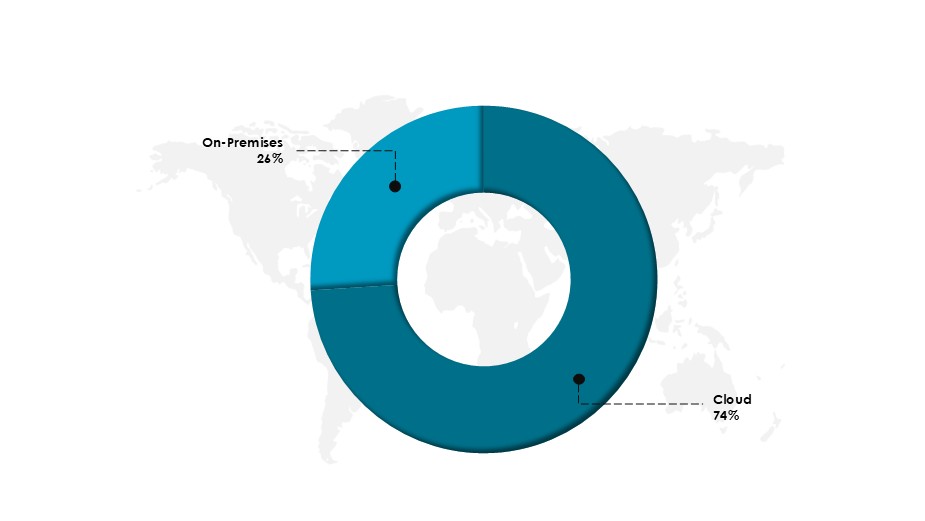

India Tokenization Market Share by Deployment

In 2024, cloud deployment dominated the tokenization market with a 74% share, driven by its flexibility, scalability, and cost efficiency. Cloud models also offer regular updates, strong encryption, and real-time access for secure token management.

The on-premises deployment, with a 26% share, enables organizations to host tokenization systems within their own infrastructure, maintaining tighter control under their internal security policies.

Tokenized Assets are Going from Pilot to Product

In 2025, J.P. Morgan completed its first tokenization of a private-equity fund on its proprietary blockchain network, marking a key milestone in modernizing fund operations and investor servicing. The pilot builds on the bank’s Onyx Digital Assets initiative, reinforcing its drive to use blockchain to enable faster, more transparent, and efficient institutional finance.

CBDCs are Moving from Research to Rollout

According to the BIS 2024 survey, 91% of central banks are exploring CBDCs. Wholesale projects are progressing fastest, while retail CBDCs could be launched in around 15 countries by 2030, as per the IMF. These developments align with tokenization, since on-chain assets need on-chain money for seamless, instant settlement.

Conclusion

The story of tokenization and decentralized currency is moving from flashy experiments to real-world efficiency, with instant settlements, 24/7 transfers, programmable compliance, and lower operating costs. India’s progress with UPI-scale innovation, CBDC pilots, and a regulated tokenization sandbox positions it to set global benchmarks for the developing world. By 2025, having a tokenization pilot and an on-chain cash strategy isn’t early; it’s the new standard.

Data Sources: Ledger Insights Ltd., Bank for International Settlements, Grand View Research, DataBridge, International Financial Services Centres Authority, Reuters, and others.

Other Market Insights