The AI in Indian Fintech: Revolutionizing Fraud Detection & Credit Scoring

AI is rapidly reshaping Indian fintech by automating risk decisions, detecting sophisticated fraud, and extending credit to underserved customers. Machine learning models and real-time analytics let lenders and payments firms spot anomalous behavior, speed loan adjudication, and reduce false positives, improving profitability and financial inclusion simultaneously. Adoption is concentrated in fraud detection, credit scoring, customer service, and compliance workflows.

India AI in the FinTech Market

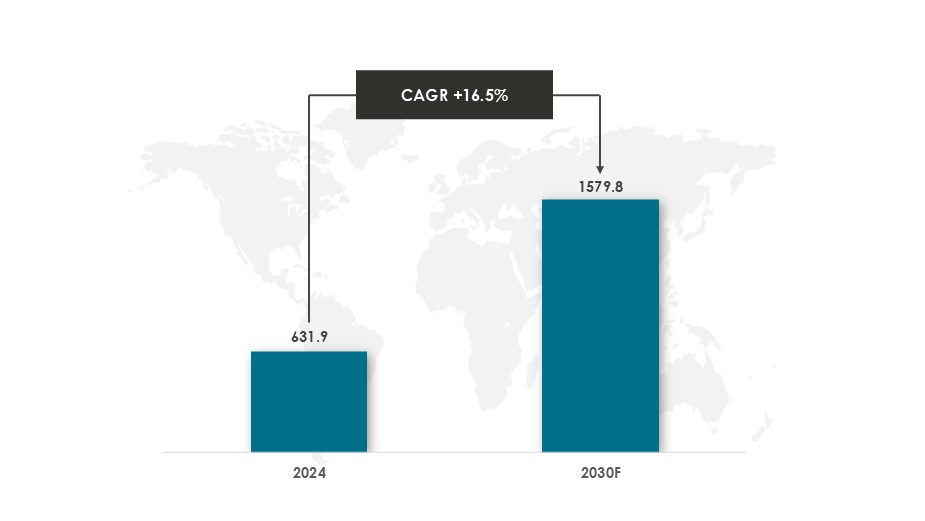

In 2024, the Indian AI market in the FinTech sector was valued at $631.9 million. The AI market in FinTech is expected to grow and reach $1,579.8 million by 2030.

The India AI in the FinTech market will be growing at an approximate CAGR of 16.5% during the forecasted period 2025-2030.

Key Drivers: India’s rapid shift to digital-first payments and lending (UPI growth, digital wallets, BNPL, and expanded digital lending) has both created enormous data that enables AI models and raised fraud volumes that demand automated detection. Recent spikes in reported cyber-fraud cases further underscore the urgency.

Market Trends and Statistics

AI in FinTech Share by Application

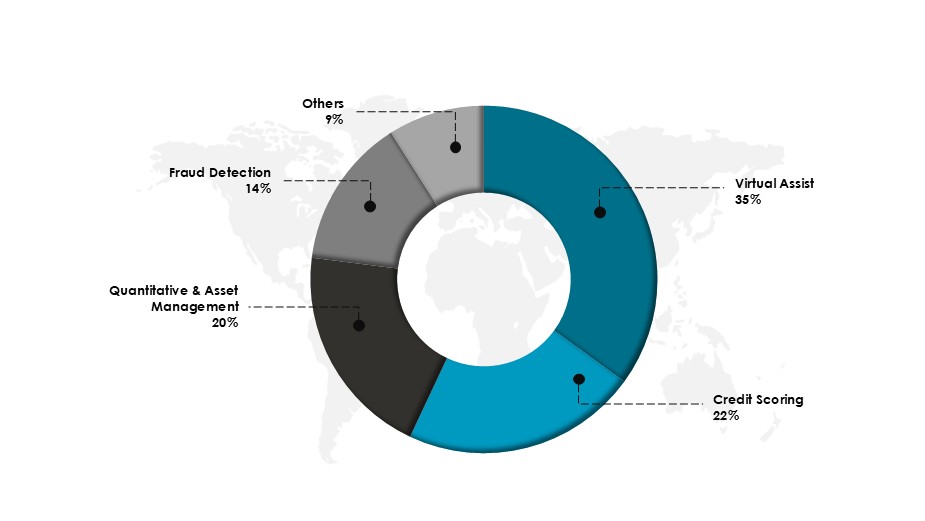

AI adoption in fintech is most visible across four core applications. Virtual assistants lead with a 35% share, driven by widespread adoption of chatbots and conversational AI that streamline customer service at scale.

However, Credit scoring (22%) and Fraud detection (14%) are rapidly gaining market presence with a combined share of 36% share reflecting the rise of digital lending platforms that use machine learning and alternative data to underwrite new-to-credit borrowers and increase security.

The Urgency of AI in Combating Fintech Fraud

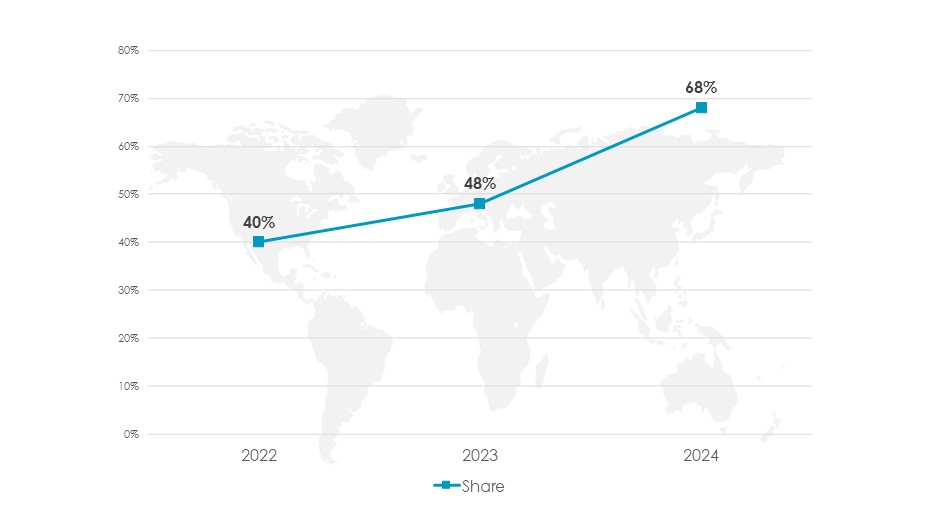

AI adoption in India’s fintech ecosystem is rapidly accelerating, with the BFSI sector leading at 68% adoption, driven by its heavy reliance on AI for fraud detection, risk management, and operational efficiency.

In financial services, the most visible impact is in addressing the rising scale of fraud within digital transactions and lending activities, such as:

1. Escalating Fraud Risks: In FY25, the total value of frauds in Indian banking, spanning both loan-related and digital payment cases, surged to ₹36,014 crore, up sharply from about ₹12,230 crore the previous year. UPI frauds alone grew by 85% in FY24, with incidents rising from 7.25 lakh to 13.42 lakh and the value doubling to over ₹1,087 crore.

2. Concentration in Digital Payments: Nearly 49% of all banking fraud cases in FY23 were linked to digital payment channels, including cards and internet-based transactions. By the first 10 months of FY25, digital financial frauds had already crossed 2.4 million incidents, causing losses of about ₹4,245 crore.

Market Statistics: Fraud Detection & Credit Scoring

AI is reshaping India’s fintech landscape, with its biggest impact seen in fraud detection and credit scoring.

1. Fraud Detection and Security: Unlike traditional systems that are largely reactive, AI models continuously analyze transactional data and flag suspicious activities as they occur. According to McKinsey, this has resulted in a 20-30% reduction in fraud cases, significantly improving security across digital payment channels.

2. Financial Inclusion and Microfinance: Machine learning algorithms leverage alternative data such as mobile phone usage, utility payments, and transaction history to assess borrower creditworthiness more accurately. This approach has driven a 40% increase in loan disbursements to rural areas, helping microfinance institutions extend services to previously excluded populations.

AI is becoming indispensable in India’s fintech, driving both fraud prevention and inclusive credit access. As digital transactions surge, AI will remain central to building trust, reducing risk, and powering sustainable growth in financial services.

Read More on FinTech

Data Sources: International Journal for Multidisciplinary Research, IMARC, Market Research Future, KPMG, The Times of India, The Economic Times BFSI, CNBC TV18

Other Market Insights