Why Rural India Is Becoming the Next Big Frontier for Neobanks

In India, neobanks are digital-only banking platforms that operate on top of licensed banks or NBFCs, providing app-based accounts, payments, credit, and financial tools without holding a banking license.

While PMJDY has expanded to ~50 crore accounts by August 2023, rural users still face barriers such as distant branches, few tailored products, limited small-ticket credit, and low financial literacy.

According to PwC studies, neobanks have identified tier 2/3 towns and rural areas as important untapped opportunities, particularly among MSMEs and informal-sector workers who are underserved by traditional branch-led models.

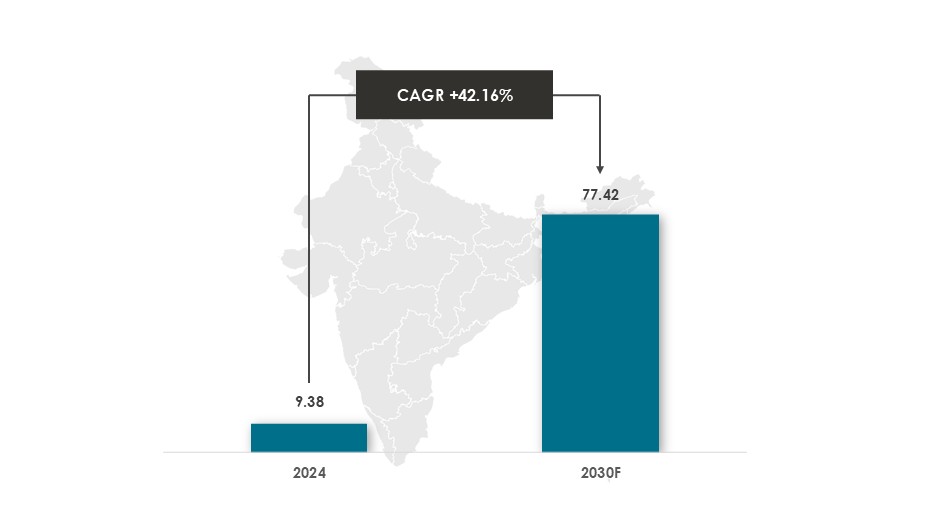

Indian Neobank Market

In 2024, the India Neobank market was valued at $9.38 billion. The market is expected to grow and reach to $77.42 billion by 2030

The India Neobank market will be growing at an approximate CAGR of 42.16% during the forecasted period 2025-2030.

Key Drivers: India’s neobanking market is driven by reduced banking fees, greater convenience, faster digital onboarding, rising financial inclusion, shifting customer preferences, supportive regulations, advancing technology, and increasing smartphone and internet use.

Market Trends and Developments

UPI Infrastructure for Neobanks

➤ In 2024, Razorpay collaborated with Airtel Payments Bank and launched ‘UPI Switch’, a cloud-based UPI infrastructure designed to handle ~10,000 transactions per minute. It aimed at improving success rates by 4–5%. ‘UPI Switch’ is used by neobank-style fintechs to offer reliable payments without building their own UPI stack.

Establishment of Digital Banking Units (DBUs)

➤ In April 2022, the RBI issued DBU guidelines following the Union Budget 2022-2023. This enabled scheduled commercial banks to set up digital-only banking outlets in 75 districts to extend digital services deeper into rural and semi-urban India. DBUs complement neobanks by creating more digital-ready infrastructure in rural regions.

Digital Banking Channels Authorisation Directions

In July 2025, the RBI issued draft Digital Banking Channels Authorisation Directions, 2025, to propose stern regulations and governance for digital channels. These strict regulations will shape how neobanks and partner banks integrate cross-selling and third-party services. Such regulations include:

➤ Restrictions on banks promoting third-party products on digital platforms without an explicit RBI nod.

➤ More robust risk checks and explicit customer consent for online banking.

Specific Rural Focus Initiatives

➤ PayNearby’s ‘Digital Naari’ initiative with state rural livelihood missions trains rural women as BC Sakhis to deliver banking, insurance, and commerce services locally, thus creating a community-driven inclusion model that neobanks can plug and integrate into.

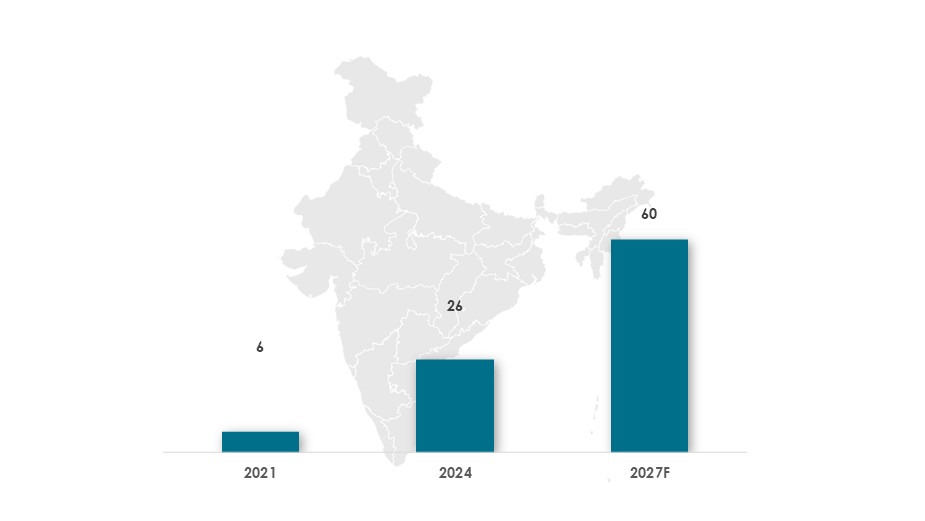

India’s neo-banking sector is rapidly growing. In 2021, there were ~6 million users, which grew and is expected to reach ~60 million by 2027, a tenfold increase within six years. This increase indicates rising trust in digital banking and greater financial inclusion.

Notable Startups & Rural-Focused Neobank Models

Jai Kisan: Rural Neo Bank for Farmers & MSMEs

Jai Kisan is a rural-focused neobank that provides digital financial services to individuals and businesses in rural India through its mobile application, i.e., Bharat Khata app.

It offers instant digital credit for farming needs, with eligibility checks and approvals that can be completed in about 10 minutes, in multiple Indian languages.

PayNearby – Branchless Banking Network for Rural India

PayNearby is a branchless banking network that uses a network of local retail stores to provide financial and digital services to communities in rural India.

It has partner outlets across 20,000+ PIN codes, offering cash withdrawal, deposits, money transfer, insurance, e-commerce and more. Its ‘Digital Naari’ programme targets rural women entrepreneurs, training them to deliver digital and financial services.

Kaleidofin – Neobank for Informal-Sector & Semi-Urban/Rural Users

Kaleidofin is an Indian neobank that provides tailored digital financial solutions to around ~600 million underbanked population in the country’s informal economy and semi-urban and rural areas.

It has impacted 4.7 million+ lives and facilitated $2.7+ billion in loans, many in semi-urban and rural districts. It uses its own credit-health score (kiScore) and analytics to underwrite low-income, semi-formal customers.

India has achieved mass account ownership and rising FI Index scores, but rural gaps persist in usage, quality, and access to small-ticket, tailored products. The neobanking market is scaling extremely fast powered by smartphones, UPI, and evolving customer preferences. Neobanks are becoming an important layer on top of India’s public digital infrastructure to deepen financial inclusion in rural India.

Data Sources: MarketsandData, IBEF, Stride Ventures, The Times of India, PWC, Drishti India, and others