Early Adopters of Green Hydrogen are reshaping the Global Energy map

The global green hydrogen market is experiencing rapid growth, fuelled by the global push for decarbonization, rising investments in renewable energy, and favourable government policies promoting clean fuels. Green hydrogen, produced using electrolysis powered by renewable sources such as wind and solar, is emerging as a key solution for zero-emission fuel in sectors such as transportation, heavy industry, and power generation. With increasing demand for sustainable alternatives to fossil fuels, green hydrogen is positioned to play a critical role in the energy transition, offering a scalable pathway toward achieving net-zero carbon goals.

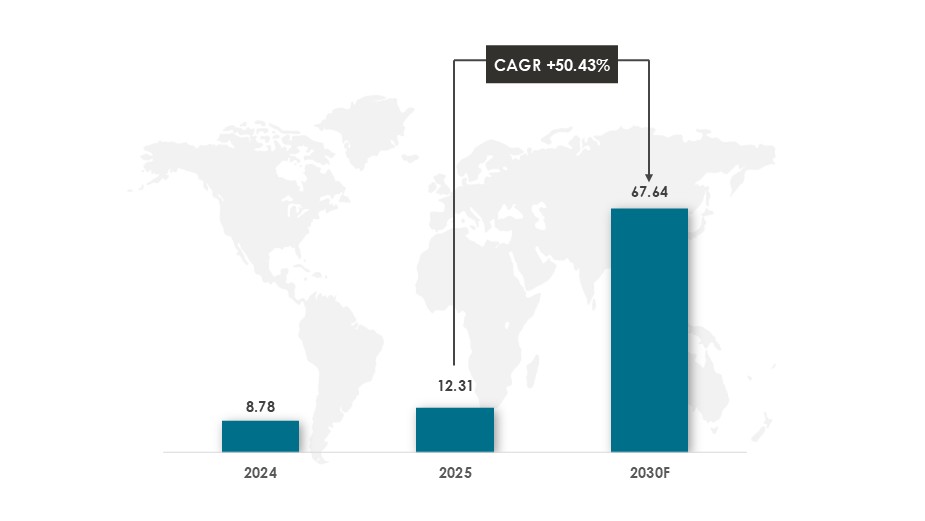

Global Green Hydrogen Market

In 2024, the global green hydrogen market was valued at $8.78 billion. The global green hydrogen market is expected to grow and reach to $67.64 billion by 2030.

The global green hydrogen market will be growing at an approximate CAGR of 50.43% during the forecasted period 2024-2030.

Key Drivers: The global green hydrogen market is expanding rapidly, driven by the push for decarbonization, increasing use of renewable energy, and strong government support. Green hydrogen, produced via electrolysis powered by solar or wind, is emerging as a clean fuel for transport, heavy industry, and power generation. Falling technology costs and the need for energy storage solutions are further boosting demand. As countries aim for net-zero emissions, green hydrogen is becoming a key pillar in the global energy transition.

Pioneers in Green Hydrogen Adoption

The global green hydrogen market is expanding rapidly, driven by decarbonization goals, government incentives, and rising demand from sectors such as refining, mobility, and power generation. Leading companies are investing heavily in electrolyser manufacturing, renewable-powered hydrogen production, and infrastructure development.

Air Liquide

Electrolyzer Factory: In November 2023, Air Liquide and Siemens Energy unveiled a gigawatt-scale electrolyzer factory, ramping up capacity for future hydrogen production.

Hydrogen Airport JV: In June 2023, Air Liquide teamed with Groupe ADP to form “Hydrogen Airport,” a specialized engineering venture supporting airports with green hydrogen solutions.

U.S. Hydrogen Hubs: Selected in 2023 for six DOE-sponsored hydrogen hubs, as part of a $7 billion U.S. initiative under the Bipartisan Infrastructure Law.

TotalEnergies

Normand’hy Electrolyzer: Teamed with Air Liquide in September 2023 to build a 200 MW electrolyzer in Normandy, aimed at supplying 10,000 t/year of green H₂ to its refinery starting mid-2026, avoiding ~150,000 t CO₂ emissions annually.

Thyssenkrupp / Thyssenkrupp Nucera

Electrolyzer Expansion: In May 2023, to supply electrolyzers to Sweden’s first large-scale green steel plant, using 20 MW modules totalling 700 MW capacity.

Water Electrolysis Pilot: Thriving 2 MW pilot plant in Duisburg, accelerating scale-up of electrolysis for heavy industry since 2023.

600 MW FEED Study: In June 2025, awarded front-end engineering design study for a 600 MW electrolyzer project in Europe.

NEOM Green Hydrogen Complex:

Part of a $8.4 billion JV (with Air Products and NEOM) in Saudi Arabia; by 2026, this will generate 600 t/day of green H₂ and 1.2 million t/year of green ammonia.

Some Notable Partnerships and Investments

China Launches First Underground Green Hydrogen Project in Daye:

In May 2025, China began production at its first green hydrogen project at Daye Green Power’s $476m facility in Hubei province, which uses electrolysers supplied by Sungrow Hydrogen. The project initiated at the 27MW facility in the city of Daye is the first in China to store hydrogen in an underground cavern and employ both 5MW alkaline electrolysers and a 2MW PEM machine.

Vilnius to Host Lithuania’s First 3MW Green Hydrogen Plant for Clean Public Transport:

In May 2025, MT Group, in collaboration with Vilnius City Municipality and Vilnius Heat Networks, the largest supplier of centralized heat in Lithuania has signed an engineering, procurement and construction (EPC) contract for building a 3MW green hydrogen plant in Vilnius, Lithuania. The project is scheduled to start up in the first half of 2026 is anticipated to produce up to 3.45 million metres of green hydrogen annually for replacing diesel-fuelled public transport buses in the city.

U.S. Firm Opens Green Hydrogen Electrolyser Gigafactory Near Doddaballapur:

In July 2024, a U.S.-based company inaugurated a green hydrogen electrolyser electrolysis using renewable energy, advancing India’s green hydrogen production capabilities.

Major Green Hydrogen Alliances Form in Oman and Europe:

In April 2024, Oman’s Hydrom signed an $11 billion deal with EDF Group to develop two green ventures in June 2022 to mass-produce renewable hydrogen electrolysers in Europe, targeting a capacity of 3 gigatons per year by 2025.

Conclusion

The global green hydrogen economy is gaining momentum as countries and corporations accelerate their shift towards clean energy. With the market expected to grow from $8.78 billion in 2024 to $67.64 billion by 2030 at a CAGR of 50.43%, early adopters such as Shell, Siemens Energy, and Ørsted are driving innovation across refining, wind, and PEM electrolyser segments. Strategic investments, such as underground storage in China, urban mobility projects in Lithuania, and gigafactories in India, underscore the sector’s global scale and diversification. As green hydrogen becomes a vital enabler of decarbonization and energy security, coordinated public-private efforts and technological breakthroughs will be key to unlocking its full potential.

Frequently Ask Questions

What is green hydrogen and how is it produced?

Green hydrogen is hydrogen produced using electrolysis powered by renewable energy sources such as wind and solar, making it a clean and sustainable fuel.

What factors are driving the growth of the global green hydrogen market?

The growth is driven by the global push for decarbonization, increased investments in renewable energy, government policies promoting clean fuels, falling technology costs, and the need for energy storage solutions.

Which sectors are the primary consumers of green hydrogen?

Green hydrogen is mainly used in transportation, heavy industry, and power generation sectors as a zero-emission fuel.

Who are some of the key companies and initiatives leading the green hydrogen industry?

Leading companies include Air Liquide, TotalEnergies, and Thyssenkrupp, with initiatives like large-scale electrolyzer factories, hydrogen infrastructure projects, and strategic alliances in Oman and Europe.

What is the projected market size and growth rate of the green hydrogen market from 2024 to 2030?

The market was valued at $8.78 billion in 2024 and is expected to grow to $67.64 billion by 2030, with an approximate CAGR of 50.43% during this period.

Data Sources: Precedence Research, GMInsights, HydrogenInsight, MT Group, The Hindu, Saudi Gulf Projects, Hydrogen Tech World, Reuters, Air Liquide, Total Energies, HydrogenTechWorld, and Acme Power

Other Market Insights