Defense Electronics Market Sees Explosive Growth

The global defense electronics market is undergoing significant transformation, driven by advancements in technology, evolving warfare needs, and increasing geopolitical tensions. Defense electronics encompass systems used in communication, surveillance, weaponry, and electronic warfare that enhance military capabilities across air, land, sea, and space platforms.

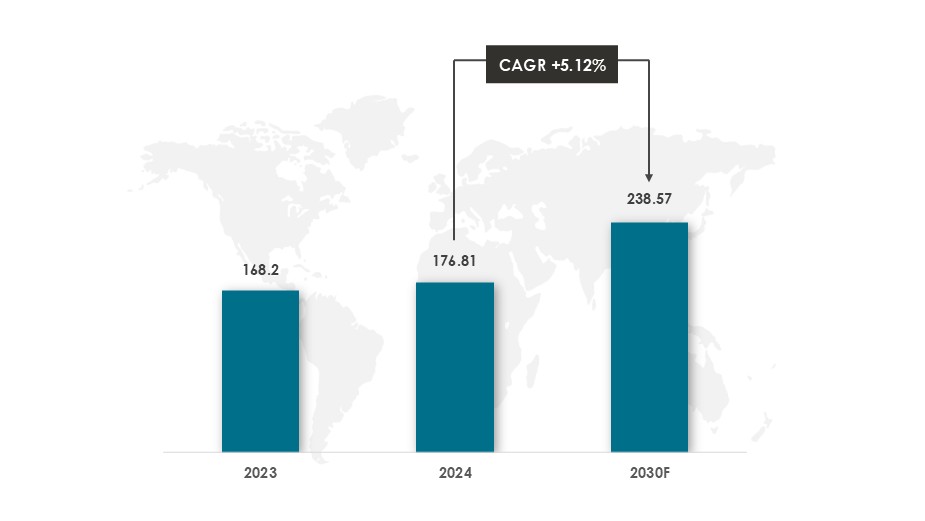

Global Defense Electronics Market

The global defense electronics market was valued at $176.81 billion in 2024 and is expected to reach $238.57 billion by 2030.

The global defense electronics market will grow at an approximate CAGR of 5.12% from 2024 to 2030.

The navigation, communication, and display segment represented 34.9% of the global defense electronics market.

The airborne segment represented 40.5% of the global defense electronics market.

Key Drivers: The defense electronics market is driven by rising global defense spending, modernization of military systems, and increasing geopolitical tensions. Demand is further fuelled by the integration of AI, IoT, and 5G in defense operations, along with a growing focus on cyber defense and border security.

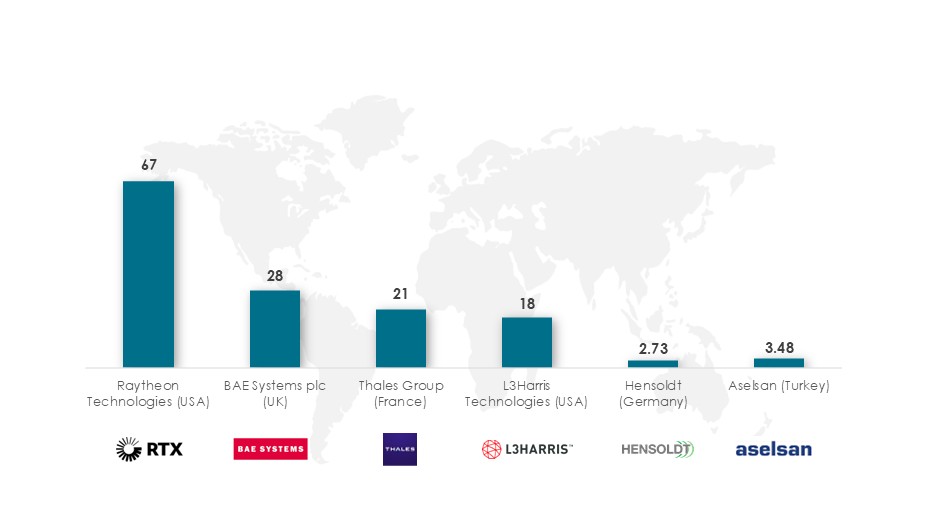

Pivotal Players in the Global Defense Electronics Market and Their Segment-Wise Revenues

The defense electronics market is segmented based on applications such as navigation, communication, display, C4ISR, electronic warfare, radars, and optronics. Among these, communication systems emerged as the largest sub-segment by revenue, while navigation systems, especially those used in unmanned platforms, are the fastest-growing, driven by the increasing demand for autonomous and precise navigation solutions.

Below are the key global players in the defense electronics arena and a breakdown of their 2024 revenues, particularly to the Nav-Com-Display segment:

➡️ Raytheon Technologies (USA): Raytheon reported a revenue of $67 billion in 2024, with a large portion derived from advanced radars, secure communications, avionics, and sensor systems, which form the core of the navigation, communication, and display segment.

➡️ BAE Systems plc (UK): BAE Systems generated $28 billion in 2024, with its Electronic Systems division, including tactical radios, integrated data links, and military-grade display technologies, contributing significantly to this figure.

➡️ Thales Group (France): Thales posted $21 billion in 2024 revenue, with over 50% stemming from defense electronics, particularly tactical communications, mission avionics, and cockpit/display systems for air and naval platforms.

➡️ L3Harris Technologies (USA): The company’s communications systems division alone earned $18 billion in 2024. Additional revenues came from avionics, ISR-enabling products, and battlefield communication systems, reinforcing its stronghold in the Nav-Com-Display space.

➡️ Hensoldt (Germany): Hensoldt recorded revenues of $2.68–2.78 billion in 2024, marked by a 28% increase in order intake for sensor and avionics systems, which are extensively used in navigation and communication applications.

➡️ Aselsan (Turkey): Aselsan reported a $3.48 billion revenue in 2024, primarily from communication systems, military radars, avionics, and targeting pods, indicating a strong presence in both the communication and optronics verticals.

Some Notable Partnerships and Investments in the Defense Electronics Market

➡️ Raytheon: In April 2024, Raytheon, a business unit of RTX, received a $344 million contract to produce two missile variants: the SM-2 Block IIICU and SM-6 Block IU. The missiles will share common components, including the guidance section, target detection device, flight termination system, and electronics unit, allowing for unified production line manufacturing

➡️ SAAK International’s Digital Transformation: SAAK International, a Saudi Arabian industrial and defense electronics manufacturer, launched a digital transformation of its production processes in partnership with Rockwell Automation in February 2024. This initiative uses Rockwell’s Plex Manufacturing Execution System (MES) to boost operational and production-line efficiencies, in line with Saudi Vision 2030.

➡️ Hensoldt’s Takeover of ESG: In April 2024, German defense firm Hensoldt acquired ESG, a defense electronics and logistics specialist, for approximately €675 million. This acquisition strengthens Hensoldt’s expertise in design and system integration within the defense sector, supporting major projects such as the F-35 fighter jets and P-8 Poseidon aircraft.

➡️ BAE Systems Wins DARPA Contract: In May 2024, DARPA issued a $12 million contract to BAE Systems’ FAST Labs for support of the THREADS program for the investigation of thermal management issues related to defence electronics. The program seeks to overcome temperature boundaries on power-amplifying functions in monolithic microwave integrated circuits (MMICs) that use gallium nitride (GaN) devices.

Conclusion

The Global Defense Electronics Market stands robust, with a steady growth trajectory propelled by rapid tech adoption. Governments are prioritizing investments, while M&A deals are bolstering capabilities in AI, drone, and space domains. Airborne platforms remain dominant, but the space-based and electronic warfare (EW) sectors are gaining momentum. The industry is poised for continued expansion through 2035, success will depend on agile adaptation by manufacturers and strategic funding from defense agencies.

Stay tuned to Innovius Research for ongoing market insights and data-driven analysis.

Data Sources: Market.us, Precedence Research, RTX.com, Rockwell Automation, Hensoldt, BAE Systems, Intellectual Market Insights, and Reuters

Other Market Insights